Every human being in this world trying different methods to earn money to satisfy their own or their family needs.People make money in different way,Some do the work hard and earn money;Some make others to work hard and earn money and the third category seek how my money will grow if i am investing in money market.When we talk about investments,there are many instruments lying behind the investment world.

Every human being in this world trying different methods to earn money to satisfy their own or their family needs.People make money in different way,Some do the work hard and earn money;Some make others to work hard and earn money and the third category seek how my money will grow if i am investing in money market.When we talk about investments,there are many instruments lying behind the investment world.

There are few familiar investment methods 1.Investing in Land or House 2.Investing in Gold 3.Investing in Share and Derivative Markets. The first two investments are more liked by everyone as it is thought to be simple and safe but it has it's own limitation.Investing in Share Market needs little effort and periodic update about the day to day occurrence in Market and knowledge about the sector in which the investment is made,especially need to have good tracking on the company in which we have invested.Sometimes due to so many factors planning,tracking and focusing on investments might not happen properly from everyone which tend to make our investment to return losses.From the above we all can understand investing in share and derivative markets has it underlying risk if we do not have sufficient methods and knowledge to tune it to take profit from it.

There are few familiar investment methods 1.Investing in Land or House 2.Investing in Gold 3.Investing in Share and Derivative Markets. The first two investments are more liked by everyone as it is thought to be simple and safe but it has it's own limitation.Investing in Share Market needs little effort and periodic update about the day to day occurrence in Market and knowledge about the sector in which the investment is made,especially need to have good tracking on the company in which we have invested.Sometimes due to so many factors planning,tracking and focusing on investments might not happen properly from everyone which tend to make our investment to return losses.From the above we all can understand investing in share and derivative markets has it underlying risk if we do not have sufficient methods and knowledge to tune it to take profit from it.

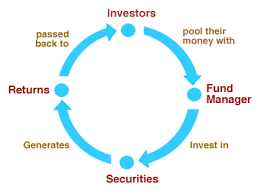

What is a finest way to invest in Market with low risk appetite,Mutual

fund is one of the way to invest in market with low risk factors.To

simplify the Mutual fund and its investing style -Mutual fund are the

fund houses who collect money from public investors and the money

collected will be invested in various instruments by specially appointed

fund managers of the fund house.The responsibility of the fund manager

is to identify the correct instrument for investment and investing in

the same so that returns will be as expected.And the returns and total

sum collected from public will be accounted every day and based on the

total number of investor and total investment net asset value(NAV) will

be updated every day.The no of unit allocated to the investor and the

NAV of the fund will give the total worth of our investment .From this

once could calculate whether our investment given positive or negative

returns.Since we do not directly involve in identifying the sector and

investment the risk is prone by the fund house and fund managers always

look forward to generate good returns to the investor.

What is a finest way to invest in Market with low risk appetite,Mutual

fund is one of the way to invest in market with low risk factors.To

simplify the Mutual fund and its investing style -Mutual fund are the

fund houses who collect money from public investors and the money

collected will be invested in various instruments by specially appointed

fund managers of the fund house.The responsibility of the fund manager

is to identify the correct instrument for investment and investing in

the same so that returns will be as expected.And the returns and total

sum collected from public will be accounted every day and based on the

total number of investor and total investment net asset value(NAV) will

be updated every day.The no of unit allocated to the investor and the

NAV of the fund will give the total worth of our investment .From this

once could calculate whether our investment given positive or negative

returns.Since we do not directly involve in identifying the sector and

investment the risk is prone by the fund house and fund managers always

look forward to generate good returns to the investor.

Mutual fund investments gives two way of investment 1.One time investment 2.Systematic investment plan.In the next post both investment will be studied.

No comments:

Post a Comment